SEAI Electric Car Grant Ireland

Claim up to €300 towards the purchase and installation of an electric vehicle home charger unit

SEAI Electric Car Grant Ireland

Claim up to €300 towards the purchase and installation of an electric vehicle home charger unit

What is the SEAI EV Grant

SEAI Electric Car Grant Information

A new government funded support scheme has been introduced to assist homeowners install an electric vehicle charge point on their property. The existing free home charger scheme operated by ESB Ecars ended in 2017. The new scheme began in 2018 and provides a grant up to the value of €300 towards the purchase and installation of a home charger unit. The applicant must be the owner of an eligible new or second-hand electric vehicle (EV).

What is the SEAI EV Grant

SEAI Electric Car Grant Information

A new government funded support scheme has been introduced to assist homeowners install an electric vehicle charge point on their property. The existing free home charger scheme operated by ESB Ecars ended in 2017. The new scheme began in 2018 and provides a grant up to the value of €300 towards the purchase and installation of a home charger unit. The applicant must be the owner of an eligible new or second-hand electric vehicle (EV).

Eligibility Criteria for SEAI EV Grant

Do I qualify for an SEAI Electric Vehicle Home Charger Grant?

(All information sourced from SEAI.ie . For full details please visit SEAI website link.)

Vehicle

- Only vehicles registered new or bought second hand from 2018 onwards are eligible for a home charger grant.

- Only vehicles which are now or were previously eligible for grant support under the EV Grant Scheme are eligible.

- EVs include Battery Electric Vehicles (BEVs) or Plugin Hybrid Electric Vehicles (PHEVs).

- Vehicles purchased new in Ireland, privately imported as new or privately imported as second hand and registered in Ireland in 2018 or later are eligible.

- Second-hand cars where ownership by the applicant occurs in 2018 or onwards are eligible.

- Vehicles must be registered for private use.

Applicant

- Any private owner who buys an eligible EV in 2018 or later is eligible to apply for this grant.

- The EV must be parked on an off-street parking location associated with the home and the charger must be connected back to the fuse board of the home of the applicant.

- The Meter Point Reference Number (MPRN), which you can find on your electricity bill, will be used to confirm the location of your home.

- The property cannot be associated with a previous EV vehicle grant and charge point offer. For example, it can not have availed of the free ESB Ecars home charger pre-2018.

- Do not commence any work before the start date on your Letter of Offer otherwise, this expenditure will be deemed ineligible and you will not receive grant support for it.

Eligibility Criteria for SEAI EV Grant

Do I qualify for an SEAI Electric Vehicle Home Charger Grant?

(All information sourced from SEAI.ie . For full details please visit SEAI website link.)

Vehicle

- Only vehicles registered new or bought second hand from 2018 onwards are eligible for a home charger grant.

- Only vehicles which are now or were previously eligible for grant support under the EV Grant Scheme are eligible.

- EVs include Battery Electric Vehicles (BEVs) or Plugin Hybrid Electric Vehicles (PHEVs).

- Vehicles purchased new in Ireland, privately imported as new or privately imported as second hand and registered in Ireland in 2018 or later are eligible.

- Second-hand cars where ownership by the applicant occurs in 2018 or onwards are eligible.

- Vehicles must be registered for private use.

Applicant

- Any private owner who buys an eligible EV in 2018 or later is eligible to apply for this grant.

- The EV must be parked on an off-street parking location associated with the home and the charger must be connected back to the fuse board of the home of the applicant.

- The Meter Point Reference Number (MPRN), which you can find on your electricity bill, will be used to confirm the location of your home.

- The property cannot be associated with a previous EV vehicle grant and charge point offer. For example, it can not have availed of the free ESB Ecars home charger pre-2018.

- Do not commence any work before the start date on your Letter of Offer otherwise, this expenditure will be deemed ineligible and you will not receive grant support for it.

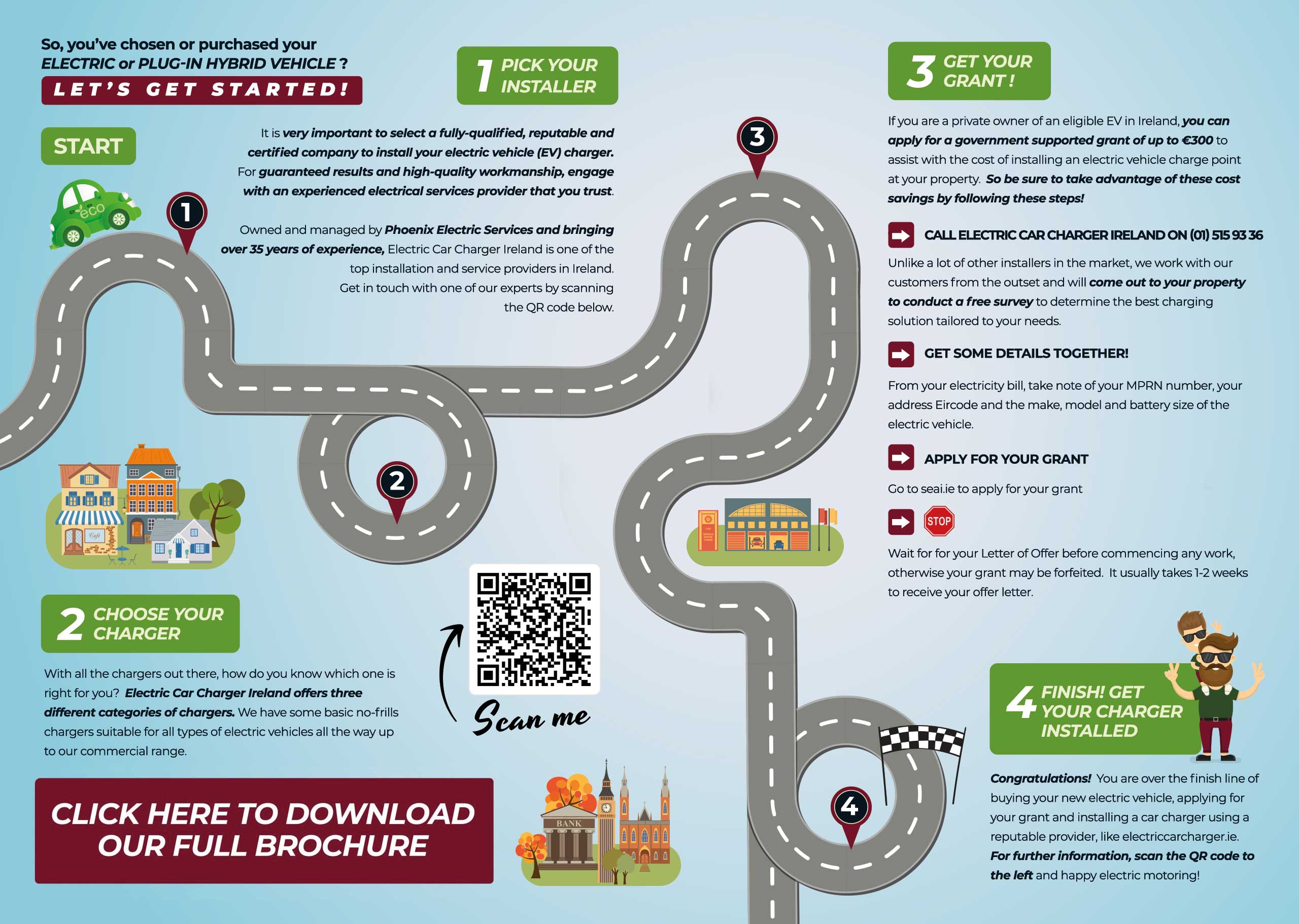

TAKE THE CONFUSION OUT OF THE EV CAR CHARGER BUYING & INSTALLATION PROCESS WITH THESE

SIMPLE STEPS

TAKE THE CONFUSION OUT OF THE EV CAR CHARGER BUYING & INSTALLATION PROCESS WITH THESE

SIMPLE STEPS

SEAI Business EV Vehicle and Charger Grants

EV Charging Stations For Businesses & Employees

The Accelerated Capital Allowance (ACA) is a tax incentive scheme that promotes investment in energy efficient products & equipment. The ACA is based on the long-standing ‘Wear and Tear Allowance’ for investment in capital plant and machinery, whereby capital depreciation can be compensated through a reduction in an organisation’s tax liability.

The ACA scheme allows a sole trader, farmer or company that pays corporation tax in Ireland to deduct the full cost of the equipment from their profits in the year of purchase. As a result, the reduction in tax paid by the organisation in that year is currently 12.5% of the value of capital expenditure. By contrast, the Wear and Tear Allowance provides the same tax reduction, but this is spread evenly over an eight-year period.

For cars coming under the category “Electric and Alternative Fuel Vehicles,” the accelerated allowance is based on the lower of the actual cost of the vehicle or €24,000.

For more information on this, please refer to https://www.seai.ie/energy-in-business/accelerated-capital-allowance/

Visit our blog post for : Chargers Electric Cars Popular Frequently Asked Questions answered

SEAI Business EV Vehicle and Charger Grants

EV Charging Stations For Businesses & Employees

The Accelerated Capital Allowance (ACA) is a tax incentive scheme that promotes investment in energy efficient products & equipment. The ACA is based on the long-standing ‘Wear and Tear Allowance’ for investment in capital plant and machinery, whereby capital depreciation can be compensated through a reduction in an organisation’s tax liability.

The ACA scheme allows a sole trader, farmer or company that pays corporation tax in Ireland to deduct the full cost of the equipment from their profits in the year of purchase. As a result, the reduction in tax paid by the organisation in that year is currently 12.5% of the value of capital expenditure. By contrast, the Wear and Tear Allowance provides the same tax reduction, but this is spread evenly over an eight-year period.

For cars coming under the category “Electric and Alternative Fuel Vehicles,” the accelerated allowance is based on the lower of the actual cost of the vehicle or €24,000.

For more information on this, please refer to https://www.seai.ie/energy-in-business/accelerated-capital-allowance/

Visit our blog post for : Chargers Electric Cars Popular Frequently Asked Questions answered